what items are exempt from sales tax in tennessee

On Friday July 29 2022 and ended at 1159 pm. In the state of Tennessee only the entity that remitted the tax to the state can be refunded the tax dollars therefore Tennessee manufacturers must request a sales tax refund directly from their vendors.

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Tennessees traditional sales tax holiday on clothing school supplies and computers is the last full weekend in July.

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

. This page discusses various sales tax exemptions in Arizona. Prior to 2010 California applied the same sales tax rate to fuel as it did to other goods. In 2010 the Legislature enacted the fuel tax swapa combination of sales tax and excise tax changes designed to give the state more flexibility in.

See Figure 3 Most recently Tennessee cut its sales tax on food to 4 percent from 5 percent in 2017. Sales tax is a compulsory levy that a buyer pays when purchasing a good or service from a seller. Next year the holiday will begin at 1201 am on Friday July 28 2023 and end at 1159 pm on Sunday July 30 2023.

Would be exempt during the sales tax holiday period. So the food and drink items you sell from your brick-and-mortar store in Maine are subject to a 55 tax. When you sell online if your store meets the threshold for the states you sell goods in the items will be subject to the sales tax of those states.

Purchases and leases of items or services by and rentals or leases of real property and living or sleeping accommodations to a qualified veterans organization and its auxiliaries used in carrying out a veterans organizations customary activities. Businesses with multiple locations must include the. School supplies with a sales price of 100 or less.

Some examples of exceptions to the sales tax are. Antique clothing for wear ApronsClothing shields Athletic socks. Sets Having Exempt and Taxable Items When tax-exempt items are normally sold together with taxable merchandise as a set or single unit the.

Tennessee manufacturers can recover sales tax dollars erroneously paid on exempt items up to 3 years 36 months after the sales tax was paid. 5050 W Tennessee St Fax to. Certain bed and bath items.

This means that an individual in the state of Texas purchases school supplies and books for their children would be required to pay sales tax but an individual who purchases school supplies to resell them would not be required to charge sales tax. Four states Hawaii Idaho Kansas and Oklahoma tax groceries at the regular sales tax rate but offer credits or rebates offsetting some of the tax for some parts of the. In Arizona certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers.

So if you paid the average price in Tennessee of 13909 in 2020 the ITC of 26 would equal 3616. On Sunday July 31 2022. This credit reduces your overall price to 10293.

Arkansas cut its rate to 0125 percent from 15 percent in 2019. Annual Back to School Holiday. An example of items that are exempt from Texas sales tax are items specifically purchased for resale.

The non-food items are subject to an 8 sales tax. Sales Tax Exemptions in Arizona. What is Sales Tax.

Before the tax-exempt resale certificate process can be discussed it is crucial to understand what sales tax and what tax-exempt resale certificates are all about. The levy is usually a percentage of the total cost of a good or. When purchasing a solar panel system to install in Tennessee it is exempt from all sales tax.

Purchases of eligible products will be exempt from state sales tax including school supplies priced at 20 or less and clothing and footwear costing. Clothing with a sales price of 100 or less 2. Sales tax exemption certificates expire after five years.

850-922-0859 Tallahassee FL 32399-0160. In 2022 it began at 1201 am. Additionally the state levied 18centpergallon excise taxes on gasoline and diesel fuels.

The following are exempt. Different Sales Tax Rates Apply to Fuel. While the Arizona sales tax of 56 applies to most transactions there are certain items that may be exempt from taxation.

No items used in trade or business are exempt under these provisions. Tennessee Code Annotated Section 67-6-393.

Tennessee Sales Tax Guide For Businesses

States Without Sales Tax Article

Tennessee Sales Tax Small Business Guide Truic

/cloudfront-us-east-1.images.arcpublishing.com/gray/DGDTWA76IVAQHEX5KGFPCU3FXQ.jpg)

Three Sales Tax Holidays Coming Soon In Tennessee

Three Sales Tax Holidays Coming Soon In Tennessee

Sales Tax Alabama Department Of Revenue

Tennessee Groceries Will Be Tax Free For The Entire Month Of August Check Here For A List Of Included Items Thunder Radio

Tennessee Sales Use Tax Guide Avalara

Jackson Tennessee Tennessee Tax Free Weekend

How Do State And Local Individual Income Taxes Work Tax Policy Center

/cloudfront-us-east-1.images.arcpublishing.com/gray/5YXZBGUB2JOFHMEMQXP2BPHUCI.jpg)

Tax Free In Tennessee Save On Food Items This Week

Tennessee Sales Tax Guide For Businesses

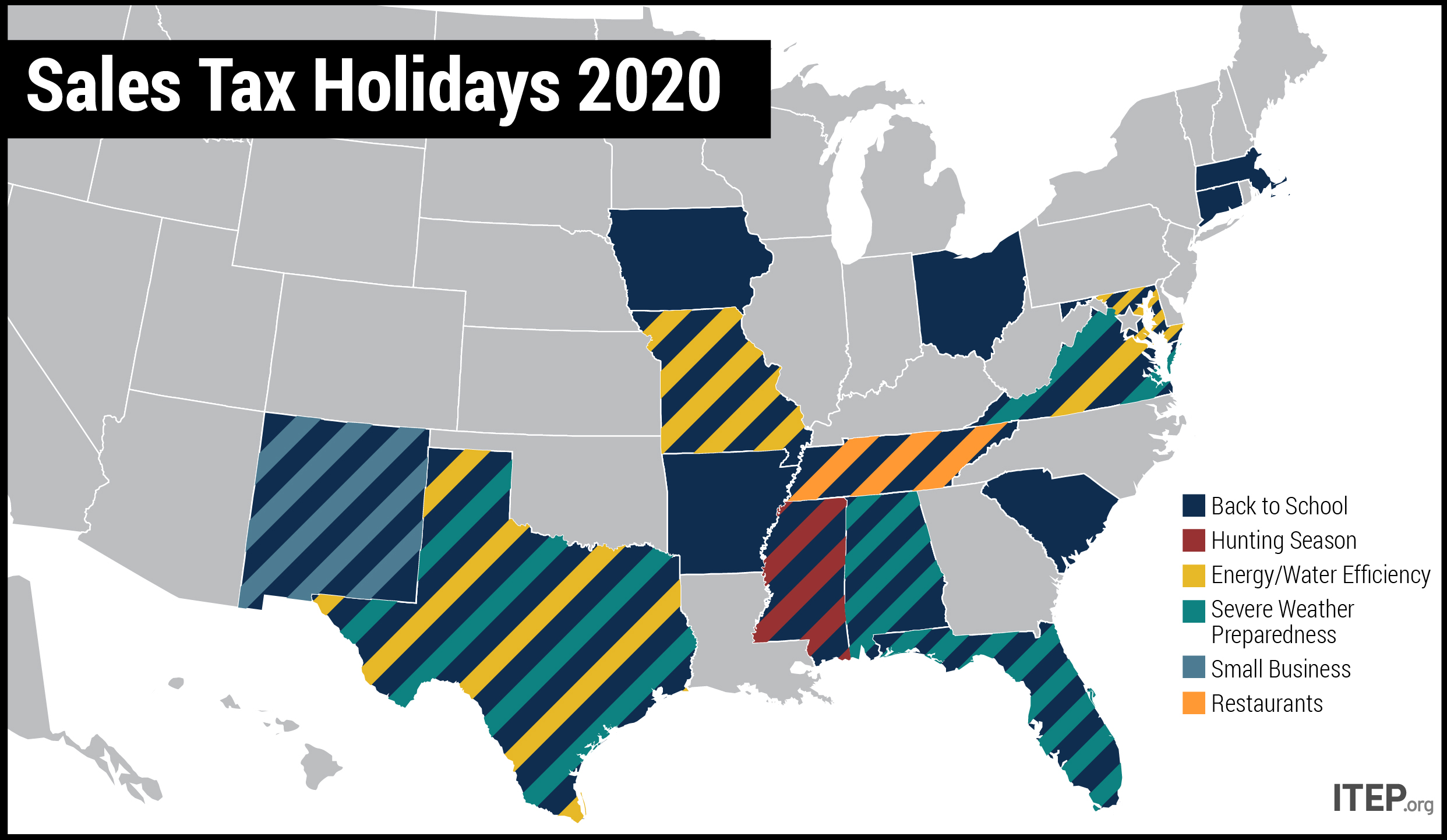

Sales Tax Holidays An Ineffective Alternative To Real Sales Tax Reform Itep

List Of Tax Exempt Items Baby Receiving Blankets Emergency Kit Tax Holiday

Jackson Tennessee Tennessee Tax Free Weekend

Sales Tax On Grocery Items Taxjar

Tennessee Bill Would Exempt Groceries From Sales Tax For May Through October 2021 Wbir Com Rainy Day Fund Sales Tax Tennessee

Sales Tax Exemption How To Avoid Sales Tax In Trucking Youtube Trucks Tax Exemption Tax